In 1987 Michael Fish, a BBC weather forecaster, became infamous for reporting a few hours before the worst storm to hit South East England in three centuries that there was no need to worry – as the hurricane would hit France, not England!

The economist profession faced a similar situation in the aftermath of the 2008 financial crises with many asking: “Why did no one see it coming?”

It seems clearly evident that the economists of the time did not possess the right tools to see what was right around the corner – massive defaults and liquidity problems spreading across the interconnected economies of the world.

Gertjan Vlieghe, one of the Bank of England’s most senior policymakers, acknowledged recently that the next time around was unlikely to be different: “We are probably not going to forecast the next financial crisis, nor are we going to forecast the next recession. Models are just not that good.”

The financial committee of the Icelandic Parliament also noted in a recent report that economic forecasting was bound to be inaccurate due to flaws in economic models.

So there seems to be somewhat of a consensus, even within the profession itself, that modern economics is simply not capable of accurate predictions. Perhaps it is time to try another approach? This is what researchers at IIIM are doing, in a way that turns the field on its head.

Economic models of today are by and large based on assumptions that allow theories of economic activity to be turned into mathematical equations. Equations are then calibrated with coefficients that will ensures they fit with data from the past. This, many argue, is rather backwards, or certainly more backward looking than forward looking. We can keep feeding more accurate and better data into these models but that is only likely to yield better results if indeed the models are based on a firm scientific ground and capture the real underlying mechanism of the economy.

A real science of economies, with a solid scientific foundation based on cause-effect relations, such as used in Meteorology, seems as far away as ever. Ideally, just as we already have for weather reporting, we would have models of economies that – unlike statistical models – capture real causal factors in the economy. This would allow us to write software simulations that could be used to answer complex questions with actual data, questions that otherwise would be the source of endless arguments.

IIIM has taken an alternative approach motivated by this simple insight and is developing the first atomic level simulation of the economy under the leadership of computer scientist Dr. Jacky Mallett. Instead of asking what the theory says, as is the norm, she asks how the causal forces in the economy behaves and what their relationships are. Capturing these accurately, as the history of scientific discovery shows, will not only produce “believable” results, it will produce accurate results that mirror how the physical world behaves: Capture the atomic structure correctly and the materials produced by mixing them together in various ways will mirror what we see in the real world.

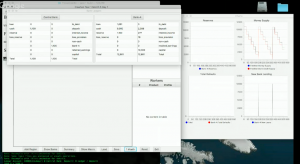

IIIM’s agent-based software simulation Threadneedle builds on a double-entry book keeping engine – its “atomic level” – which faithfully represents every transaction through the ledgers of the computerized banking system thus simulating real banking activity. The software is then able to monitor how the collective transfers of the agents affect the underlying economy.

At this point in time Threadneedle is a work in progress. We don’t claim it’s the perfect solution to every question. But we do claim that it is the most scientific way of dissecting and understanding the banking system, which at this point has grown very complex, especially when international relations are taken into account. And we are pretty sure that whoever takes a scientific approach to economics will reap plenty of benefits. The code is now open source for you to scrutinize on Github.