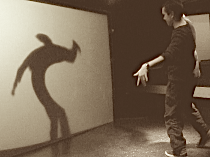

Have you ever wondered what would happen if your shadow had a life of its own? IIIM specialists Gunnar Steinn Valgardsson (Chief Technology Developer, demo author) and Hrafn Thorri Thórisson (concept author, advisor) introduced the LivingShadows project to discover just that. The LivingShadows program scans a person’s outline and transforms it into an interactive figure. Rather than being a mere projection, it is its own entity. The shadows act independently so that people can interact with their own shadows, and their shadows can interact with other shadows.

Most of IIIM projects are entirely scientifically motivated, but LivingShadows plays on the border of technology and art.

Worldwide Interconnectivity

Future versions of LivingShadows will enable people all over the world to connect their installations together.

LivingShadows: Scenario Example

Entering the hallway, the viewer sees a series of shadow figures moving along the wall. The figures are standing about, sitting down, some of them come and go on their way to unknown destinations. One shadow seems to be reading a newspaper, another paces back and forth while looking at her watch.

The only traces of their hidden world are revealed by the shadows on the wall. The viewer steps in front of the wall and see their shadow appear on the wall. The shadows stop for a moment to stare at him, then return to their business. The participant waves at the shadow reading the newspaper. The shadow puts down his paper and waves back. One by one he interacts with the other shadows in the virtual waiting room. Finally, the participant waves both his arms and suddenly it begins to rain. All of the shadows take out umbrellas to shelter them from the rain.

by Kristinn R. Thórisson,

by Kristinn R. Thórisson,

Threadneedle Street, London. Famous for being the site of the Bank of England.

Threadneedle Street, London. Famous for being the site of the Bank of England.